Are you looking for a reliable method to safeguard your retirement savings from the effects of inflation and market fluctuations? Take a look no further.

If you’re planning to invest, it’s time to move your funds out of the traditional IRA. To make the process simpler, we’ve put together a guide to help you choose the best silver IRA rollover companies.

The Silver Retirement Accounts (Silver IRAs) offer an ideal chance to diversify the portfolio using an actual asset.

Investing in a silver IRA can be a wise option for diversifying your investment portfolio and protecting against the effects of inflation. However, you must be aware of the fluctuation in silver prices as well as the additional maintenance expenses to determine if it’s an appropriate option for your retirement portfolio.

The process of a Silver IRA rollover is quite simple. The first step is to open a self-directed IRA by establishing a custodian who permits alternative assets such as precious metals.

Companies such as Goldco, Augusta Precious Metals as well and Birch Gold can help you with the paperwork needed to get established. The majority of them require an investment of at least $50,000 or $100,000 to start.

The silver IRA rollover allows you to diversify your investments into an actual asset that can hold value regardless of the state of other investments. Additionally, the tax benefits of an IRA ensure that your investments in silver can increase in value for many years too. It’s a win for any smart investor who’s looking forward to the future.

A lot of people have been the same before they found the valuable metals IRA. They are a type of self-directed account that allows investors the possibility of investing in precious metals.

People have purchased precious metals such as silver and gold for a long time, so there is no need to worry when opening an account in a silver IRA.

What silver is IRA approved?

To be deemed IRA permissible precious metals and be recognized by STRATA The below minimum requirements for fineness must be met. Silver must be 99.9 100% pure, gold has to be 99.5 percent pure Platinum and palladium both must be 99.95 percent pure.

Best Silver IRA Rollover Companies For 2024 At A Glance

- Goldco: Editor’s Choice – Best and Most Trusted Gold IRA Company Overall (4.9/5)

- American Hartford Gold: Runner up – Best Price for Bullion (4.8/5)

- Augusta Precious Metals: Great Buyback Program (4.6/5)

- Birch Gold Corporation: Great Staff Overall (4.5/5)

Numerous companies claim to provide the most valuable metals IRA in search of the top service providers. But, if you go through reviews from the Better Business Bureau and reviews on Trustpilot and Trustpilot, you will discover the top four silver IRA firms today.

#1 Goldco Precious Metals – The Most Trusted Gold IRA Company Overall [4.9/5]

Goldco is a top gold IRA firm is a leader in outstanding customer service and offers a wide range of investment options that make it a top choice for silver and gold IRA investors.

Goldco’s status as a leading gold dealer is highly deserved. It is one of the best silver IRA rollover companies.

Goldco is one of the best-known investment companies and silver IRA suppliers. Goldco specializes in simplifying the complicated processes that help investors secure their investments in valuable metals.

If you’re searching for an organization that can assist you in diversifying your investments through precious metals Goldco should top your wish list.

Goldco allows the execution of the gold IRA rollover, transferring your money from traditional to silver IRAs. Although many think the process is difficult, the staff at Goldco strives to ensure you’re faced with no obstacles.

You will need a financial adviser to manage your portfolio of investments to invest in a significant amount. Goldco employs financial experts who are proficient in handling customer financials.

They will provide you with the expertise and expertise to make effective investments, helping you to ensure your retirement.

Goldco assists you in choosing the right custodian for your requirements. Once you’ve chosen an appropriate custodian, the company will guide you through the process of creating an account in silver IRA account.

After your account is set up, Goldco facilitates all precious metal transactions, while making sure they meet the requirements of the IRS.

You will require additional guidance when you’re just beginning to invest in the Silver IRA. Goldco offers novices a comprehensive guide that introduces the concept of IRAs and their advantages. By informing its customers and educating them, the company has an impressive track record of success that is different from any other competitor.

In addition, with one of the lowest fees in the business, this firm is one of the most well-known investment firms on our list.

Its products have earned the company an A+ grade from the Better Business Bureau. The company also has great reviews on Trustpilot as well as other independent review sites.

If you’re planning to invest in silver IRAs then you will need a straightforward method to get started on your investment. Choosing Goldco may help you get into a trouble-free, long-term investment.

Pros

- Simple account creation process

- It simplifies the process of establishing an IRA rollover

- One of the cheapest fees with a nominal annual and charges for account management.

- A+ rating by the Better Business Bureau

- We are partnered with the most secure deposits

- Reasonable due to Reasonable due to the offers clients can get, such as waivers of fees

- Rapid delivery to the depository and assurance of all orders

- Unbeatable customer service with the most up-to-date education tools

Cons

- The minimum amount of $50 is necessary to establish an account.

- There is a limited number of precious metals. Platinum and palladium are not available.

- Doesn’t operate outside of the United States

In sum, Goldco’s superior customer service as well as a variety of investment options, and extensive educational materials make it a great option for those looking to invest in the silver IRA.

#2 American Hartford Gold: Runner up – Best Price for Bullion [4.8/5]

American Hartford Gold is another top competitor in the gold IRA market, boasting an excellent name and a variety of offerings.

American Hartford Gold, established in 2015, is a family-run investment company. The primary objective of the company is to help customers build a diverse portfolio of assets. It can offer precious metals like platinum, silver, and gold.

American Hartford lets you safeguard the precious metals in an account for retirement savings. The investment you make with the company will provide an income tax-free to your portfolio.

IRAs are investments that allow individuals to take advantage of tax breaks to boost their wealth. Tax incentives like deferred payments are claimed when investing in the IRA.

Social Security will not provide the funds you need to support your retirement if you decide to retire.

The company lets you diversify your investment portfolio, spreading the risk across various assets. American Hartford provides its customers with a wide range of precious metals originating from Canada as well as South Africa.

American Hartford is less well-known than other firms that are on this list. But, the quality of its services makes it the top choice.

If you already have an IRA account and would like to convert it into a silver IRA The company’s broker works to ensure an easy transfer.

Customers need not be worried about the security of their property. The insurance covers every purchase and the company offers rapid delivery of metals.

American Hartford provides tailored solutions with different costs. The company may even waive charges in certain cases.

The company has been awarded an A+ rating from the Better Business Bureau and has persevered to keep its excellent reputation. The company also has a five rating on reliable networks like Trustpilot along with Google.

American Hartford is well-known for its exceptional customer service. Celebrities like Rudy Guiliani even support it. If you’re thinking of investing in an IRA with a silver IRA or an IRA with a gold IRA, you should contact American Hartford Gold.

Pros

- One of the top companies for silver and gold IRA company

- Offers platinum, silver, and gold IRAs

- All purchases are protected by insurance

- There is no transportation cost due to transport your silver to the depository

- AHG may reduce fees for certain customers

- The company employs financial experts to help you through the process of a silver IRA rollover

- Customer service is always available

- Financial advisors can help you decide which valuable metal for you to put your money in

- Multiple storage facilities, all with the latest security measures to safeguard your precious metals

- Endorsements from a variety of financial giants

- The Better Business Bureau rates them with an APlus for their exceptional service

Cons

- Precious metal coins don’t offer a variety but are only available in silver or gold.

- It does not provide the price of its services on the Internet.

- It does not offer any of the company’s services to customers from outside the United States

In the end, the American Hartford Group’s easy rollover procedure, competitive pricing, and wide selection of silver IRA products make it a desirable choice for investors who want to invest in an investment in a silver IRA.

#3 Augusta Precious Metals: Great Buyback Program [4.6/5]

Augusta Precious Metals provides comprehensive education and assistance, assisting investors to make educated decisions regarding their investments in precious metals, such as gold IRAs.

Augusta Precious Metals, established in 2012, is a notable provider of IRAs that are secured by precious metals. Many choose the firm for their IRAs due to the quality of their service.

To open a silver IRA account through Augusta the first step is to make an electronic transfer or transfer of funds from your existing account. The agents of the company are always available to help with the setup of your account or fund transfer as well as the acquisition of assets, which will ensure that the process is smooth.

Although Augusta Precious Metals does not charge any fees to its clients, you will have to pay the setup cost for your precious metals IRA account to the custodian they prefer, Equity Trust, in addition to storage and maintenance fees of $100.

The minimum investment needed to make a purchase of physical silver through Augusta is $50,000.

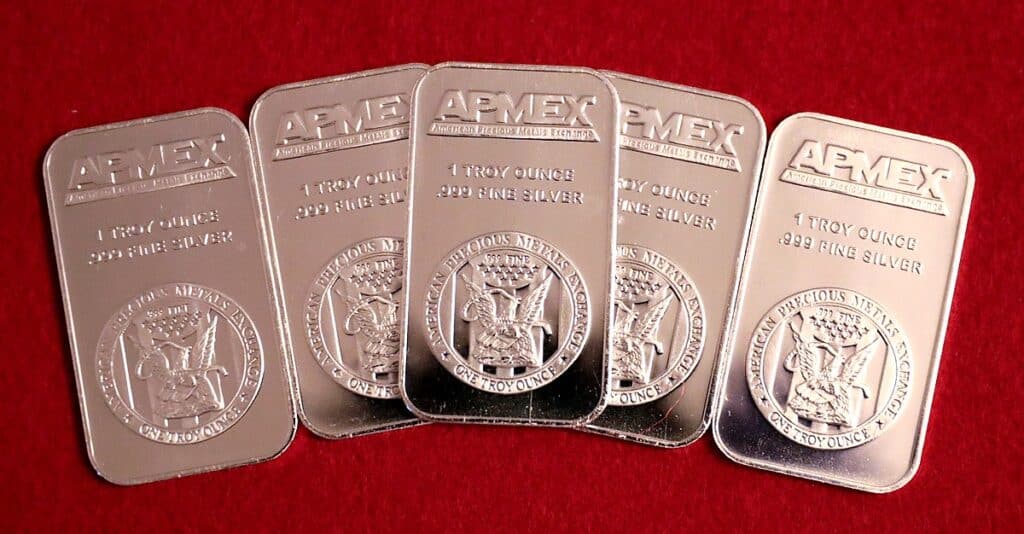

Augusta offers an extensive selection of silver coins like American Silver Eagles, Canadian Maple Leafs as well and Chinese Pandas, as well as silver bars in different sizes from famous brands such as Johnson Matthey, Engelhard, and Sunshine Minting.

In addition, Augusta provides complimentary, completely insured storage of silver in their private vaults, guaranteeing security and safety for your money.

The advantages that Augusta offers are not to be missed. Because they offer sameness and support round the clock, Augusta Precious Metals has been awarded the high place at the top of this ranking.

The company assists clients in creating portfolios of investment that are diverse which gives them more ability to control their finances future.

Although she worked with numerous firms, a lot of people were amazed by the wide array of precious metals that Augusta was able to work with.

There is an array of options for silver and gold which include silver bullion. They also handle silver coins which are ideal for a silver IRA!

Augusta Precious Metal’s clients appreciate the openness of the business’s procedures. The company doesn’t charge markups or fees and clearly labels its service prices.

Despite the many instances of unprofessional business practices in this industry The honesty of a company usually comes as an unexpected delight to its clients.

Augusta is willing to go out of the way to serve its customers. With an expert team who are experienced in managing investment portfolios, You can be assured that you will receive top-quality service from this firm.

Augusta Precious Metals is committed to building long-lasting relationships with its clients. Review reviews from satisfied customers are evidence of Augusta’s service.

A lot of people were pleased with the company offering them the data they required to invest in the market with confidence.

The company assists any client in setting up a silver IRA and effortlessly transitioning from traditional IRAs made of precious metals to retirement accounts.

If you’re just beginning to learn about precious metals This will help you in finding the right investments based on metals. Many of the world’s top economic rivals have endorsed Augusta Precious Metals, and they have many happy customers.

The Better Business Bureau has awarded the business an A+ rating, which indicates that the facilities are one of the top in the industry. Augusta Precious Metals may be the ideal choice If you’re in search of a trustworthy silver investment company.

Pros

- Assists in setting up an IRA self-directed

- It offers an extensive selection of precious metals, such as platinum, silver, gold and

- A modest minimum investment of $50,000

- Employs financial experts to help its clients through their investment decisions

- A wealth of details is accessible to assist you in understanding how to use silver IRAs

- Assistance round-the-clock is readily available in the event of issues

- Zero complaints

- Depositors with a variety of partners to help you select one near you.

- Delivers depositors’ items quickly Most within 10 days

- Certain IRA accounts may receive reimbursements for charges in silver coins

- Better Business Bureau rates its services with an A+

Cons

- A website that is ambiguous and has no details about its services.

- There are very few options for bullion.

- Only operates inside the United States

With its commitment to providing comprehensive education and assistance, Augusta Precious Metals is an ideal option for investors who require guidance and assistance in the management of their precious metals IRAs especially in the area of tangible precious metals as well as silver IRA investments.

#4 Birch Gold Corporation: Great Staff Overall [4.5/5]

If you are looking to roll on an older IRA or an old 401(k) in precious metals Birch Gold Group is a reliable option. They offer a simple process to convert your accounts to physical silver and gold.

Birch Gold Group should be your top choice if you are looking for an established company that you can invest in.

With 17 years of expertise in managing investments, the company is the most seasoned IRA supplier on this list.

With years of expertise, The firm’s advisors can assist you in establishing and meeting your financial goals.

Birch Gold makes it incredibly easy for novices to invest in silver IRAs.

If you’re a member of an existing valuable metal IRA and would like to start the process of rolling it over, our brokers will make sure the procedure is simple!

With their tailored advice They strengthen their relationships with their clients.

If you’re still unsure about the Silver IRA The company will make sure they dispel any misinformation by offering educational material.

The tools that are available on the website will make sure you are aware of the ins and outs that will benefit you from your investment.

The firm lets you set up an auto-directed IRA that allows you to invest in various precious metals.

They offer silver, palladium as well and gold, at the most affordable rates due to the low markups.

In addition, Birch Gold provides a buyback guarantee on all its sales, if you decide to dispose of your valuable metals.

Birch Gold has built its reputation on its top services. It offers bars, coins, and bullion in exchange for the precious metals you decide to invest in.

The company ensures that its advisers are always ready to offer assistance and suggestions to boost your investment and take it to the highest level. You will likely be able to do nothing but be unhappy about a company such as this.

With such services and the quality of these services, it’s no surprise that the company has garnered several positive reviews on the internet.

The Better Business Bureau rates them with an A+ for the reason of their focus on specifics when dealing with clients.

Reviewers on Trustpilot found no defects, either, nearly giving these five-star reviews.

Birch Gold may be the ideal choice for you if looking for an established investment company to help you invest with confidence.

Pros

- A low minimum investment of just 10,000; perfect for beginners

- The most skilled IRA service providers with more than 17 years of experience

- The educational materials on their website will help you become familiar with IRAs

- It’s easy to initiate the silver IRA rollover, with the help of its staff ready to assist you through the process.

- Purchases of more than $50k are exempt from the annual cost.

- The customer service is always accessible in the event of any questions

- A variety of precious metals like silver, palladium, and gold.

- The partnership with depositories throughout the United States makes their services more accessible

- Low markups mean that the spread is very minimal

Cons

- A site that is ambiguous and does not provide the details of the charges

- It does not provide traditional IRAs

- It doesn’t offer the services it does outside the United States

Why Choose Birch Gold?

Birch Gold has been helping Americans invest in the market for precious metals for the past 10 years. The benefits of working with them are:

- Highly highly rated. They have an A+ rating from the Better Business Bureau and numerous 5-star reviews by customers.

- Excellent customer service. Birch Gold prides itself on white-glove customer service with a knowledgeable and helpful staff.

- Competitive pricing. They procure metals at affordable prices, maximizing the worth of your IRA.

- Secure and safe storage. Your precious metals are secured and insured in secured vaults in the largest U.S. cities, all under your name.

Benefits of Silver IRAs

There are many people out there who are investing in traditional IRAs or 401ks and are unsure what the reason is for them to investigate silver IRAs. It is typical for those who aren’t aware of the purpose and purpose of an investment to doubt its legitimacy.

The instability in the market for stocks has led people to look for alternative investment opportunities for investing in. The price of precious metals is also volatile; however, it is not as volatile as other commodities.

In contrast to other metals, buying silver doesn’t require the purchase of a large amount of cost. Silver is affordable and has an excellent reputation for those who choose precious metals.

Silver’s price has remained the same lately, however, it hasn’t drastically decreased. In times of uncertainty for the economy, such an asset is essential. People look for silver when they no longer believe in money that is printed on paper.

Why Invest in Silver IRAs?

Do you require clarification on the reasons you should invest in a Silver IRA? Don’t fret; this section provides all the advantages of this investment!

Strong Industrial Demand

Silver isn’t only a hot product in finance markets. Industries are extremely interested in this metal because the metal is an essential component in their products. Due to the current shortage, the need for this metal will likely increase significantly in the next few months!

Many industries require silver to meet various needs across the globe. It is an important component of the energy production process in the production of solar panels.

Water treatment facilities utilize the metal to cleanse water sources across cities.

Additionally, the substance is also used in batteries and semiconductors and batteries, which are in the process of becoming depleted. This is partially due to its high value.

It is not certain that the production of silver will be sufficient to meet the increasing demand in the next few months. The lack of supply will likely lead to an upsurge in the price of silver. Therefore, it is the perfect time to place your money in the precious metals.

Profit from the opportunity to get an investment moonshot. Contact an investment firm and create a self-directed silver IRA account!

Global Demand

Did you know that the demand for silver in the world grew by more than 19 percent in 2021? 1.05 billion tons of this metal was sought in 2021. That’s an incredible number! But, the demand has been steady.

Demand for silver is predicted to hit an all-time historic high by at the close of 2022. The experts believe that they will utilize 1.112 billion tons of this wonderful metal around the world.

Aside from the industries, many people require silver for various reasons. A few metals are thought of when we think about jewelry, but sterling silver is one of them. It can easily be sculpted into intricate designs and requires minimal maintenance.

Silver is also a popular investment in silver bars and bullion. Numerous countries throughout the globe use silver in their currency. Today it is typical for investors to purchase bars and coins made of silver. The demand for these products was up by 36 percent in the year 2021.

Another major usage for silver is in the silverware of cutlery as well as ornamentation. Silver is utilized to make decorative objects that are utilized in households across the globe. Silver demand in various industries has been increasing in addition.

Hedge Against Inflation

With time the value of the value of paper currency may decrease and lose value. It is a good investment to hold silver because it is an excellent security against economic recessions and inflation. Although the value of the dollar has sunk due to the consequences of the pandemic, precious metals have reached record-setting levels.

It has a negative association with the US dollar and this may surprise you. Silver’s value is likely to rise over time, whereas the value of it is a fact that money fluctuates.

Incorporating a portion of your savings in gold is an excellent strategy for the long run to ensure the financial security you need in retirement.

The currency of the world helps support the value of silver as a weak currency usually leads to higher prices as a result of the increased demand. This is due to speculation, which causes people to purchase more silver when the dollar is weak.

Therefore, the price of silver rises when the value of the dollar is reduced due to inflation. This protects your money from declining.

Tax Advantages

A silver IRA lets your investments in silver bullion increase tax-free. You will only pay taxes if you take withdrawals in the silver IRA account of your retirement account.

In addition, when you begin taking withdrawals from a silver IRA account these distributions are subject to the tax rate of traditional IRA and 401(k) distributions.

A silver IRA provides the same tax advantages as a traditional retirement account but also exposes you physically to silver in the form of one asset class.

Diversification

A silver IRA provides diversification for your retirement portfolio. Instead of solely relying on paper assets such as bonds and stocks you can have exposure to physically silver-based bullion.

This can reduce the overall risk as silver is a commodity that moves independently from the market for stocks. A retirement portfolio that is diversified and includes precious metal coins, as well as other investments in precious metals as well as other assets, is more stable during market volatility.

What is a Silver IRA Rollover?

After you have set up a self-directed IRA account, you’ll need to transfer funds to begin investing. If you don’t possess any retirement savings plan, you will have to transfer funds to your account to purchase silver.

You have to complete the silver IRA rollover if you are enrolled in an existing retirement plan with your employer. This involves moving funds from one IRA to another. You can transfer some or all of your assets into the account. You can also create a new IRA account.

To begin the rollover process, you need to submit a request for transfer for the IRA provider. Do not assume custody of the property or else you may be charged an amount of money!

Your IRA provider will likely complete the paperwork and conclude the rollover process quickly.

Understanding What a Silver IRA Rollover Entails

You may have heard that silver as well as gold are an excellent way to hedge against inflation, but just like many others, you may be hesitant.

Are the terms used to describe silver IRAs complicated? It is possible that you may be interested in understanding the meaning of the silver IRA rollover This guide will simplify the procedure.

Be aware that rolling the assets from your IRA to another one has little risk. Since you don’t need to declare the ownership of your assets, the likelihood of a fine or penalties is small.

Your silver IRA custodian and provider handle many rollovers every day so you don’t have to fret!

The IRA providers can utilize two methods to complete a Silver IRA rollover. The first is that they may choose an immediate transfer. The custodian will be required to send a check to the silver IRA provider.

This will help you avoid liability because your IRA custodian and provider will be able to communicate directly.

The alternative to an option for an alternative to a silver IRA transfer is the indirect transfer. Custodians will issue you a check which you have to deposit into the silver IRA within 60 days.

If you do not meet the sixty-day deadline, the IRS will assess penalties for premature withdrawal of funds.

What types of accounts can be converted to a Silver IRA?

If you are thinking about moving your funds from one account into another you should consider the accounts that are appropriate for a silver IRA rollover. Rollovers are an excellent method to transfer money across different accounts, which can help you diversify your investments.

Some of the following accounts can be rolled over into a silver IRA:

- Traditional IRA

- Roth IRA

- SEP IRA

- Simple IRA

- 401(K)

- 403(b)

- 457 Deferred Compensation Plan

- Pension

- Thrift Saving Plan

- TIAA CREF

- Non-prototype IRA

- Beneficiary IRA

A “Hassle-Free” Silver IRA Rollover

It is necessary to transfer funds into an IRA account to begin the process of investing in silver. While this procedure may seem to be a bit difficult you need to know that there is no need to fret.

When you work with a reliable IRA provider If you work with the right IRA provider, you will be able to enjoy a pain-free gold IRA transfer and can begin making investments in no way.

The process of buying silver and other precious metals is straightforward in auto-managed IRAs. As we have explained there are two options when it comes to rolling over. It is best if you choose an immediate rollover.

This is a common practice to help to avoid taxes by shifting money out from your traditional IRA.

If you’ve got an old money account for investments that is not performing it is time to think about an IRA rollover to have enough cash for retirement.

Plans such as 401(k), 403(b), and 457(b) are highly vulnerable to the uncertainty that is prevailing in this economic downturn.

Transfer your funds to the silver IRA by making a quick phone call to the custodian of your account to transfer the funds you have in your existing scheme to the IRA.

Final Thoughts – Best Silver IRA Rollover Companies

Silver is an ideal investment to put into your IRA. Silver is the perfect option for a long-term investment which can help you to protect yourself from the effects of inflation.

Goldco is the ideal choice for you if you are looking to select the best gold IRA provider. Goldco is one of the most knowledgeable IRA providers, and they have the expertise to make sure that their customers have a smooth easy, and hassle-free IRA rollover.

The company is known for its honesty and customer service and has helped its clients feel confident in its services. You’ll be amazed by how simple their procedures are after you have a look at their offers.

The company provides educational materials and educational materials that are ideal for those who are just beginning to would like to know the basics of silver IRAs. They will be delighted by the service the knowledgeable staff offers.

When you are establishing an account for precious metals IRA account, be sure to conduct your study. Consider the advantages and disadvantages of investing in silver and decide on the best option for you.

If you are planning to roll into the silver IRA make sure you choose the best silver IRA rollover companies to make the process swift.